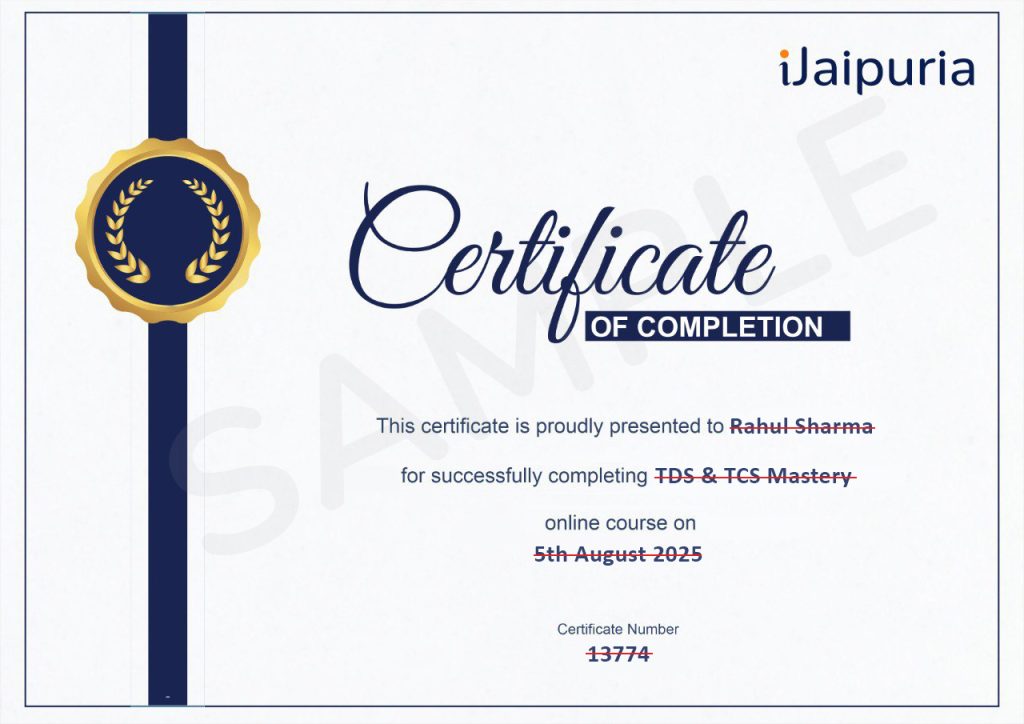

Assured Certification

TDS & TCS Mastery

(English)

Starting at ₹14 Per Day

Select iJaipuria’s Growth Accelerator Plans

Enroll in this course and gain access to 100+

additional industry-relevant courses

________ or ________

Assured Certification

Course Highlights

Course Highlights

- Understand The Complete Lifecycle Of Tax Deducted At Source (TDS) And Tax Collected At Source (TCS) — From Deduction/Collection To Deposit And Return Filing.

- Learn To File TDS/TCS Returns Using Utilities Like Java, CSI, RPU; Generate FVU Files; And Submit Forms Like 26Q, 24Q, And 27EQ On The Income Tax Portal.

- Step-By-Step Guidance On Applying For TAN (Form 49B), Registering PAN/TAN On The Income Tax And TRACES Portals, And Downloading Certificates (Form 16/16A).

- Record And Manage TDS/TCS In Multiple Practical Cases — Including Salary And Non-Salary Deductions, And Single Vs. Multiple Employee Deposits.

- Learn Payment And Return Due Dates, Track Return Status, Understand Penalties, And Ensure Accurate Filing To Stay Fully Compliant.

About the Course

06 Hours 30 mins

29 Lessons

3 Practice Tests

10 Assignments

998 Learners

12 Months Access

Course Structure

- Introduction 01.01

- Ways of Collecting Income Tax: Self Assessment Tax, Advance Tax, TDS, TCS 27.00

- Know Basic Terms used in TDS and TCS 6.31

- TDS Process Overview: Cycle of TDS 11.43

- TDS Deposits: Payment Due Dates, Penalties 2.35

- TDS Returns Forms Dues Dates, Penalties 9.53

- TDS Certificates Form 16-16a 3.26

- How to Apply for TAN – Form 49B 8.24

- PAN and TAN Registration ON INCOME TAX PORTAL 9.48

- TAN Registration on TDS Traces Portal 8.07

- TDS Recording Case-1: Deduction & Deposit 48.57

- TDS Recording Case-2: Deduction & Deposit 24.10

- TDS Recording Case 3: – Deduction & Deposit 24.20

- TDS Returns: Download Software’s, CSI, Java, RPU 10.18

- TDS Returns: Filling 26Q, Generate FVU, File Returns on Income Tax Portal 23.37

- Check TDS Returns & RRR Number on IT Portal 1.47

- View TDS Return Status on TDS Traces Portal 1.40

- Download TDS Certificates Form 16A 4.26

- Calculate TDS on Salary 37.12

- Deposit TDS for One or Many Employees 21.07

- TDS Returns: Download Software’s, Winrar, CSI, Java, RPU 5.43

- TDS Returns – Filling 24Q (Q1-Q3), Generate FVU, File Returns 21.51

- Download TDS Certificates-Form 16 5.03

- Register PAN on TDS Traces Portal (Using Aadhar, Deductors, Challan Info) 15.11

- Download Provisional Form 16/16A from TDS Traces Portal 6.00

- TCS Overview & Cycle 6.36

- TCS – Collection & Deposit (Case 1) 22.35

- TCS – Collection & Deposit (Case 2) 7.04

- TCS – Collection & Deposit (Case 3) 5.30

- TCS Returns Preparation & Filing 27EQ 15.24

Your Instructor

Ravi Thelugu

Founder & CEO – Vedanta Educational Academy

Tally Certified Trainer | GST Practitioner | TEPL Content Developer

Course FAQs

This course is open to everyone! Whether you’re a commerce or non-commerce student, a business owner, job seeker, or working professional — the course starts from the basics, making it ideal for learners at all levels.

Absolutely. No prior tax or accounting knowledge is required. The course begins with foundational concepts and gradually moves into practical, real-world applications of TDS and TCS compliance, return filing, and portal usage.

You’ll gain job-ready skills like applying for TAN, registering PAN/TAN on government portals, calculating and depositing TDS/TCS, filing returns (26Q, 24Q, 27EQ), generating Form 16/16A, and using software like RPU, CSI, and Java Utility—exactly what’s expected in modern tax and accounting roles.

Yes. The course content is fully aligned with the latest updates in income tax laws, portal features, and compliance procedures—so you stay current with due dates, penalty norms, and return filing guidelines.

Upon completing the payment process, you will receive an email confirmation from our team within five minutes. You can then use your login credentials to access the course through the Dashboard, allowing you to learn at your own pace and convenience.

Upon completing the course, you will receive a certificate of completion, which you can download from your Dashboard.

Earn a Certificate

After finishing the course, you will get a Certificate of Completion.

Demonstrate Your Commitment

Be a growth-driven professional and advance your career by learning new skills

Share your Accomplishment

Showcase your verified iJaipuria certificate on your social media platforms and CV